Advertiser Disclosure

Last update: December 16, 2024

5 minutes read

US Bans Navient From Federal Loans

CFPB bans Navient from federal student loan servicing. Learn how this affects borrowers, reshapes the loan landscape, and how to protect your financial future.

By Brian Flaherty, B.A. Economics

Edited by Yerain Abreu, M.S.

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Yerain Abreu, M.S.

Learn more about our editorial standards

On September 12, 2024, the Consumer Financial Protection Bureau (CFPB) announced a permanent ban on Navient from servicing federal Direct Loans, along with hefty financial penalties. This action affects millions of student borrowers and reshapes the college finance landscape.

Key takeaways

- The CFPB has banned Navient from servicing federal Direct Loans and most FFEL Program loans

- Navient must pay a $20 million penalty and provide $100 million to compensate harmed borrowers

- This action may lead to improved practices and increased scrutiny across the student loan servicing industry

The CFPB's enforcement action: Breaking it down

What exactly did Navient do wrong?

The CFPB cited years of failures and lawbreaking by Navient, including:

- Steering borrowers into costly repayment options

- Depriving borrowers of information about affordable income-driven repayment plans

- Mishandling payment processing

These actions allegedly cost borrowers millions of dollars and led to unnecessary struggles with debt repayment.

The penalties: More than just a slap on the wrist

Navient isn't just getting a stern talking-to. The proposed order includes:

- A permanent ban from servicing federal Direct Loans

- Prohibition on servicing or acquiring most Federal Family Education Loan Program loans

- A $20 million penalty payable to the CFPB

- $100 million in redress for harmed borrowers

TuitionHero Tip

This action resolves a lawsuit initiated by the CFPB way back in 2017. That's seven years of legal battles!

Effect on current Navient borrowers

If you're a Navient borrower, you're probably wondering, "What happens to my loans now?" Here's what you need to know:

- Your loans will be transferred: Existing Navient federal loan accounts will move to other loan servicers.

- You don't need to take action: The transfer will be handled automatically in most cases.

- Watch for communications: Keep an eye out for messages from your new loan servicer about account details and payment information.

What about private loans?

The ban primarily affects federal student loans. If you have private loans with Navient, they may continue to hold or service these.

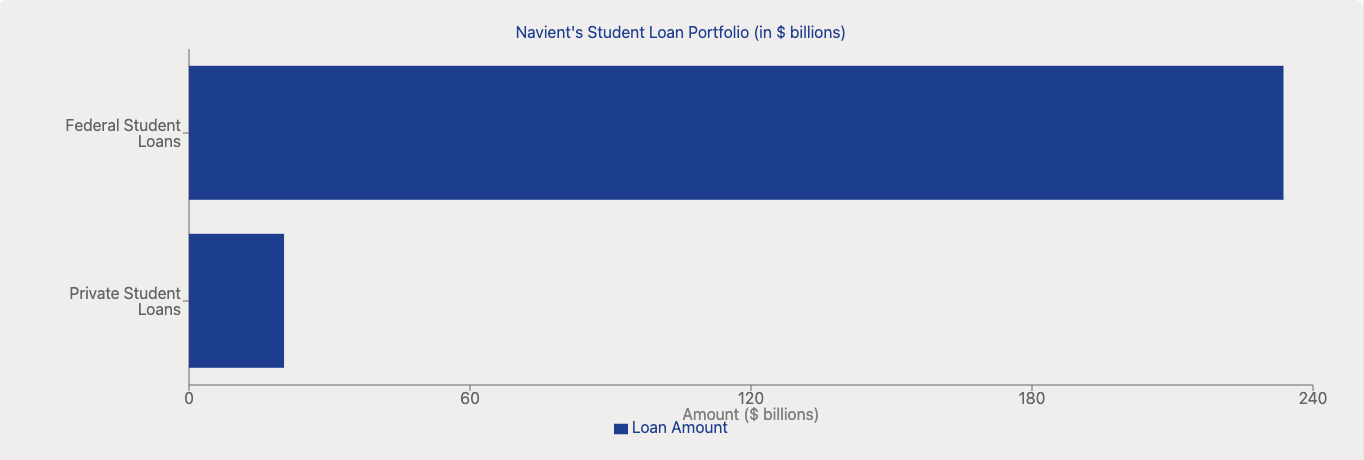

To grasp the CFPB ban's effect on Navient, let's look at their loan portfolio:

Key points:

- Federal Student Loans: $233.7 billion

- Private Student Loans: $20.3 billion

With over 90% in federal loans, this ban significantly affects Navient's operations. It affects their Direct Loans and most FFEL Program loans servicing, while their smaller private loan portfolio remains unaffected.

Source: These figures are based on Navient's Q4 2022 portfolio data, as reported in their investor presentations. While the actual numbers in 2024 may have changed slightly, this data provides a clear representation of the scale and distribution of Navient's student loan portfolio at the time of the CFPB's enforcement action.

The broader effect on the student loan market

This enforcement action isn't just about Navient – it's reshaping the entire student loan landscape. Here's how:

- Shift in loan servicing: Other servicers will likely see an increase in their portfolios.

- Improved practices: This serves as a wake-up call for other loan servicers to clean up their act.

- Increased scrutiny: Expect heightened oversight of other loan servicers.

- Potential market consolidation: We might see fewer but larger loan servicers in the future.

What's next for student borrowers?

Wondering how can you protect yourself in this changing landscape? Here are some steps to take:

- Stay informed: Keep up with communications from your loan servicer.

- Know your rights: Familiarize yourself with borrower protections and income-driven repayment options.

- Be proactive: If you're struggling with payments, reach out to your servicer to discuss options.

Remember, knowledge is power when it comes to managing your student loans!

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Resources for student loan borrowers

In light of these changes, it's crucial to know where to turn for help and information. Here are some valuable resources:

- Federal Student Aid website: Visit studentaid.gov for comprehensive information on federal student loans, repayment options, and borrower rights.

- CFPB's Student Loan Ombudsman: This office can help resolve complaints about student loans. Visit consumerfinance.gov/complaint to file a complaint or get help.

- National Consumer Law Center: Their Student Loan Borrower Assistance Project provides information and resources for student loan borrowers. Check out studentloanborrowerassistance.org.

Your school's financial aid office: They can provide guidance on loan options, repayment strategies, and connect you with additional resources.

Why trust TuitionHero

At TuitionHero, we offer tools to help manage your student loans, including refinancing options and resources for navigating financial aid. We also provide guidance on private student loans and using credit cards to save on interest. Explore our scholarships and more to support your education journey.

Frequently asked questions (FAQ)

You should receive communications from both Navient and your new loan servicer about the transfer. Keep an eye on your mail, email, and student loan account portal for updates. It's crucial to ensure your contact information is up to date to receive these important notices.

The ban itself shouldn’t affect your existing loan terms or interest rates. When your loans are transferred to a new servicer, your original loan agreement, including interest rates and repayment terms, should remain the same. However, it's always a good idea to review your loan details with your new servicer to ensure everything is correct.

If you believe you've been harmed by Navient's practices, you may be eligible for compensation from the $100 million redress fund. Keep an eye out for communications about how to claim your share if you qualify. Additionally, you can file a complaint with the CFPB if you've experienced ongoing issues with your student loans.

This action could lead to stricter oversight and improved practices in the student loan servicing industry. Future borrowers may benefit from clearer information about repayment options, better customer service, and potentially new, more borrower-friendly servicing models. It's a reminder of the importance of understanding your loans and exploring all available repayment options.

Final thoughts

As we move forward, what can we expect from the student loan industry? It's likely we'll see:

- Stricter regulations on loan servicers

- More emphasis on borrower education and support

- Potential for new, innovative servicing models

The big question is: Will these changes lead to a more borrower-friendly student loan system? Only time will tell, but one thing's for sure – staying informed and proactive about your loans has never been more important.

So, are you ready to take charge of your student loan journey? Remember, while the landscape may be changing, your goal remains the same: successfully managing your education debt and building a strong financial future.

Source

- CFPB Bans Navient from Federal Student Loan Servicing and Orders the Company to Pay $120 Million for Wide-Ranging Student Lending Failures

- US bans Navient from servicing federal student loans

- Navient banned from servicing federal student loans | CNN Politics

- CFPB bans Navient federal student loan servicing, issues $120M fine | American Banker

- US consumer watchdog moves to permanently ban Navient from federal student loan servicing | AP News

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Yerain Abreu

Yerain Abreu is a Content Strategist with over 7 years of experience. He earned a Master's degree in digital marketing from Zicklin School of Business. He focuses on college finance, a niche carved out of his journey through the complexities of academic finance. These firsthand experiences provide him with a unique perspective, enabling him to create content that's informative and relatable to students and their families grappling with the intricacies of college financing.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today