Advertiser Disclosure

Last update: June 6, 2025

9 minutes read

What Does Room and Board Mean? Definition and Examples

Discover what room and board includes: dorms, utilities, meal swipes, dining dollars, and more. Get tips to budget college living and slash expenses.

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

By Brian Flaherty, B.A. Economics

Edited by Rachel Lauren, B.A. in Business and Political Economy

Learn more about our editorial standards

Navigating room and board costs can feel overwhelming, but understanding your options is the first step toward smart budgeting. Beyond comparing dorm prices and meal‑plan tiers, you can unlock significant savings by taking on on‑campus leadership roles or using each school’s personalized cost estimator. In this post, we’ll answer what is room and board in college and reveal how you can slash expenses with strategies tailored to college setups.

Key takeaways

- Room and board refers to housing and meal plans offered in various living arrangements

- Knowing your board options like full board, half board, and bed and breakfast can help you budget more effectively

- Researching hidden costs related to room and board is essential for avoiding financial surprises

What does room and board mean?

Room and board refers to a living arrangement where you pay for both a place to stay and meals. The "room" portion covers your living arrangements, which can mean shared or private space in the dorms or off-campus.

The "board" portion covers your meals, usually served in a communal dining area. This setup is common in most universities and some temporary accommodations like boarding houses.

Room and board costs for college are influenced by whether you choose to live on-campus or off-campus. But don’t make the mistake I did and assume that the bottom line is the only thing that matters.

When I went to school, I chose to live off-campus as soon as I could because it was cheaper. But I quickly realized that it was harder to meet my friends and attend events being away from campus.

In this article, we’ll walk through how to balance all the costs and benefits of room and board - not just the financial ones. First, let’s take a look at why understanding room and board is important.

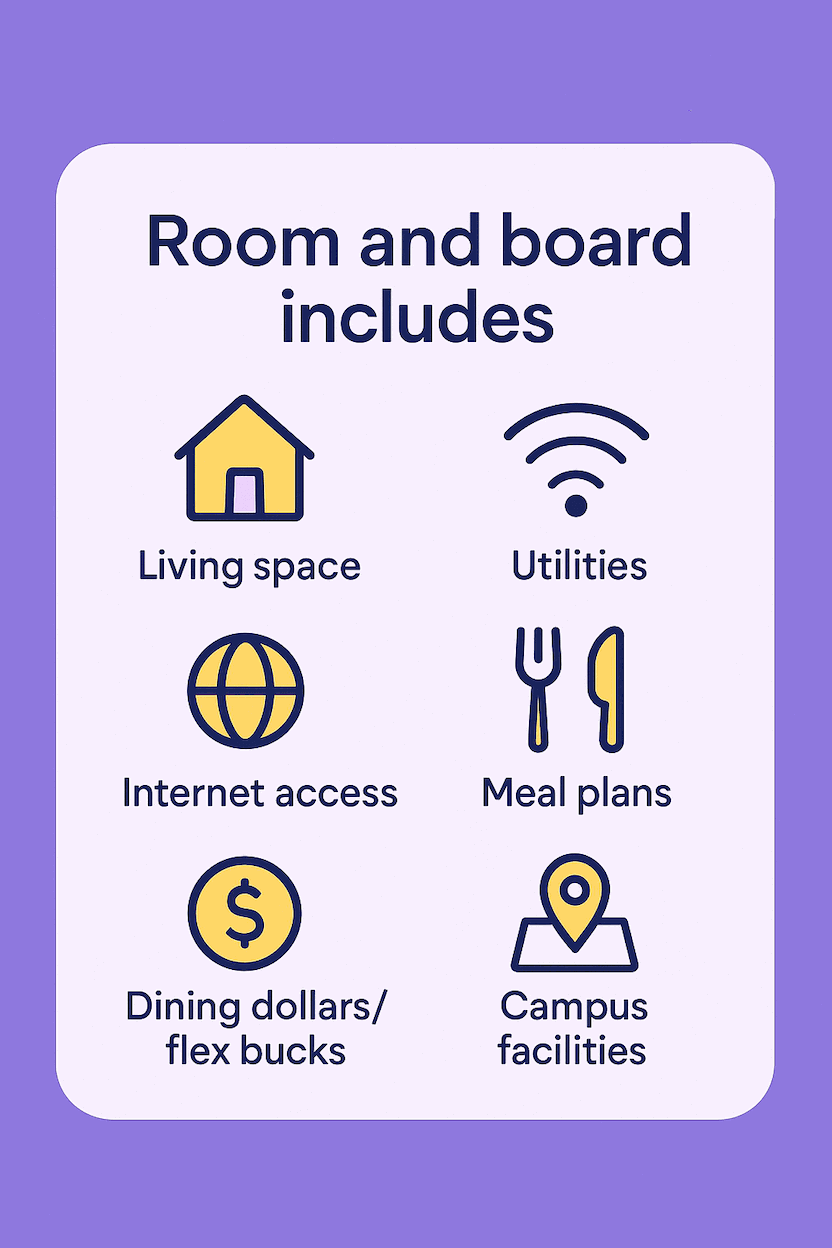

What does room and board include?

While specifics vary by campus, most packages cover:

- Living space: Your private or shared room, furnished with a bed, desk, and storage.

- Utilities: Electricity, water, heating/air conditioning, and basic maintenance.

- Internet access: Campus Wi‑Fi or wired connections in dorms.

- Meal plans: Meal swipes or block plans for dining halls.

- Dining dollars/flex bucks: Funds for campus cafés, food trucks, and convenience stores.

- Campus facilities: Laundry rooms, study lounges, fitness centers, and on‑site security.

Knowing exactly which amenities and services are included helps you avoid hidden fees—so review your school’s housing contract closely and budget with confidence.

Why it's important

Knowing what room and board includes helps you budget efficiently. For students, understanding these terms can help you optimize decisions regarding housing and meal plans. Understanding the cost breakdown can aid in better financial planning and potentially reduce the need for taking out student loans.

Types of board options

Here's a breakdown of the different types of board options you might encounter:

- Full board: You get three meals a day—breakfast, lunch, and dinner.

- Half board: This covers only one to two meals a day.

- Bed and breakfast: Literally just a place to sleep and breakfast in the morning, typically offered to parents or during university vacations.

TuitionHero Tip

Knowing these can help you choose the best option for your needs and budget.

More considerations

Besides room and board, you’ll need to think about other expenses like textbooks, transportation, and personal items. Be sure to understand what the plan covers and what extra costs you might face.

How do room and board impact my overall college expenses?

Room and board are significant components of college costs. They can represent about 1/3 of the total expenses for some students.

For example, if tuition is $20,000 annually, room and board might be another $10,000. These costs vary based on the institution and location, where urban areas tend to have higher living costs.

What other hidden costs might I encounter with room and board?

Besides the standard room and board fees, students can face more costs like laundry, internet, and dorm supplies. These small expenses can add up quickly. It's essential to budget for these extras to avoid financial surprises during the school year.

One way to handle these costs is by exploring scholarships or financial aid packages that specifically cover room and board. Parents might also consider helping their children with credit to ease these financial burdens.

Is room and board tax-deductible?

Unfortunately, in most cases, room and board expenses are not tax-deductible. The IRS primarily allows deductions for tuition and related expenses. However, some specific scholarships or grants may be used to cover room and board, providing indirect tax benefits.

Tax strategies for parents

Parents may look into educational tax credits or deductions to help lessen the financial burden. For detailed advice, see how to file taxes as a college student. These strategies can lead to big savings when planned well.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

How should I budget for room and board?

Creating a budget for room and board involves understanding all associated costs and planning for unexpected expenses. It's essential to factor in the types of board options available and any other living expenses.

Useful budgeting tips

Utilize resources on managing financial aid like this article: “how to navigate financial planning for college”. These tools can help you create a comprehensive budget that covers all your living expenses.

We've gathered data on typical room and board fees to help you plan better. Here’s a breakdown summary of typical room and board costs across different types of accommodations and dining plans.

Type of Accommodation | Average Annual Cost |

|---|---|

Public, On-Campus | $12,302 |

Public, Off-Campus | $11,983 |

Private, On-Campus | $13,842 |

Private, Off-Campus | $10,876 |

This table is based on typical costs found at various universities and can fluctuate based on location and institution. Be sure to research your specific institution's costs for an accurate budget.

Dos and don'ts of planning for room and board

Planning your room and board for college involves more than just picking a meal plan and a dorm. To get the most out of your experience and finances, follow these key dos and don'ts.

Do

Do research all of your housing and meal options

Do create a detailed budget for all related expenses

Do apply for scholarships that cover room and board

Do read the fine print in your housing contract

Don't

Don't assume the most expensive option is the best

Don't forget about more costs like transportation

Don't rely solely on loans without exploring aid first

Don't ignore meal plan details that may restrict choices

Advantages and disadvantages of living on campus

Choosing to live on campus offers multiple benefits but also comes with some challenges. We’ll explore both to give you a clearer picture of what to expect.

- Proximity to classes, libraries, and campus events

- Built-in utility packages—no separate bills to pay

- Stronger sense of community and social interactions

- Safety and security features within campus housing

- Easy access to dining halls and food options

- Higher overall cost compared to off-campus options

- Less privacy due to shared living spaces

- Potential restrictions on guest visits and quiet hours

- Limited control over room and meal plan choices

- Possibility of mandatory participation in meal plans

Cut room & board costs as an RA or resident fellow

Want to eliminate—or drastically cut—your housing and meal bills? Become a Resident Advisor (RA) or resident fellow.

If you’ve ever asked "What is a room and board package?", this role exchanges communal duties for a full or partial waiver on rent and a complimentary meal plan.

And if you're wondering, "Does room and board include food?" The answer is yes. As an RA, meals are covered as part of a complimentary meal plan.

Applications open in January–February, so submit a resume highlighting leadership and conflict‑resolution skills, and prepare to discuss floor events and roommate mediation ideas.

Other campus roles with perks:

- Desk assistant: Partial housing or meal credits for front‑desk support

- Conference staff: Free summer lodging and a per‑diem during orientation

- Graduate fellow: Larger stipends or tuition remission for grad students

Even a partial waiver can slash 30–50% off your room & board costs—pair it with a lean meal plan to free up cash each semester.

Compare room & board costs with net price calculators

In addition to RA perks, you should check what does room and board include when running net price numbers. Sticker prices don’t account for your aid package.

Use each school’s Net Price Calculator to see an itemized breakdown of tuition, fees, room, board, and extras like laundry or parking—so you can compare against your average room and board for college estimate.

How to use a Net Price Calculator:

- Find it by searching “[School name] Net Price Calculator” or in the financial aid section.

- Enter details like household income, family size, awards, and preferred housing/meal plan.

- Review results for a personalized cost of attendance.

Run calculators for multiple schools and log results in a simple table. This lets you test “what‑if” scenarios—lower‑cost meal plans, off‑campus options—and choose the setup that best fits your budget.

Why trust TuitionHero

At TuitionHero, we simplify navigating financial products for students and parents. Our tools and resources help you make informed decisions about loans, refinancing, and credit cards. Let us guide you in managing credit card debt and understanding interest rates. Empower yourself with our expert financial planning support.

Bipartisan collegiate housing act expands affordable student housing nationwide

In late March 2025, Rep. Blake Moore (R‑UT) and Rep. Terri Sewell (D‑AL) introduced the bipartisan Collegiate Housing and Infrastructure Act (CHIA) to lower college housing costs nationwide.

CHIA would amend the Internal Revenue Code so non‑profit student housing entities—like fraternities, sororities, and other recognized student groups—can receive tax‑deductible donations to build, maintain, or upgrade affordable residences.

By leveling tax treatment between university‑managed dorms and nonprofit‑owned housing, the bill could expand affordable on‑ and off‑campus options, reducing dependence on high‑cost private rentals for over 400,000 students.

Frequently asked questions (FAQ)

When choosing a meal plan, consider the frequency and timing of your meals, your dietary needs, and the location of dining facilities relative to your classes and dorm. Evaluate how often you actually eat on campus versus off-campus to avoid overpaying for unused meals.

Yes, some scholarships do cover room and board costs in addition to tuition. Be sure to research scholarships thoroughly and check their specific terms and conditions. Look out for scholarships specifically targeted at covering these expenses to ease your financial burden.

If your room and board costs exceed your budget, explore alternative housing options, like off-campus housing or different meal plans. Plus, you can look into private student loans or consult resources on income share agreements and financial aid packages to find ways to make costs more manageable.

Final thoughts

By taking on an RA or fellow role and running numbers through net price calculators, you’ll not only understand questions like "What does room and board mean?" but also see how costs vary across campuses and why the context matters.

Apply these tactics to cut your actual bills in half and reclaim funds for textbooks, internships, or simply some extra peace of mind this semester.

Source

Author

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

Editor

Rachel Lauren

Rachel Lauren is the co-founder and COO of Debbie, a tech startup that offers an app to help people pay off their credit card debt for good through rewards and behavioral psychology. She was previously a venture capital investor at BDMI, as well as an equity research analyst at Credit Suisse.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates