Advertiser Disclosure

Last update: June 11, 2025

9 minutes read

Balance Transfer Credit Cards

Looking to cut high-interest debt? Discover how a balance transfer student credit card can save you money—compare top cards, understand fees, and explore smart alternatives.

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

By Derick Rodriguez, Associate Editor

Edited by Brian Flaherty, B.A. Economics

Learn more about our editorial standards

Struggling with high-interest credit card debt can feel like running on a treadmill—no matter how hard you work, you’re barely moving forward. Balance transfer cards offer a pause button by giving you a 0% or low-APR window to slash interest costs and focus on paying down the principal.

Many readers ask, Can you balance transfer student loans to a credit card?—let’s clear that up. We’ll explore how to pick the right card and when to consider other options like balance transfer student loans alternatives.

Key takeaways

- Balance transfer credit cards offer a strategic way to save on interest charges

- Qualification typically requires good to excellent credit

- Promotional APR periods are temporary; plan to pay off the balance beforehand

What is a balance transfer credit card?

A balance transfer credit card allows you to move your existing debt to a new credit card that usually offers a low or 0% introductory APR. This strategy can greatly reduce the amount of interest you pay on your debt.

While balance transfer cards usually offer 0% APR for a set period of time, they also typically come with a balance transfer fee. This can be a fixed sum or a percentage of your transferred balance.

Who can qualify for a balance transfer card?

Qualification for a balance transfer card typically requires good to excellent credit. Scores of at least 690 are generally needed to secure the best offers.

If you’re anything like me, you probably went through a period of not having great credit. But don’t lose hope.

Over time, I was able to use simple strategies to improve my credit score and qualify for opportunities like balance transfers. To learn some of the strategies I used, explore how to use a credit card to build credit successfully.

Do balance transfers hurt your credit?

Short answer: It can, initially. When you apply for a new credit card, the issuer will perform a hard inquiry on your credit report, which might lower your credit score temporarily.

However, strategically managing your transferred balance could improve your credit score over time by lowering your credit utilization ratio and helping you build a reliable payment history.

Is it better to do a balance transfer or pay off?

This depends on your financial situation. If you can pay off your balance within a few months, doing so may save you more than transferring the balance.

TuitionHero Tip

For larger debts or higher interest rates, a balance transfer can be more cost-effective.

How to compare balance transfer cards

When you’re shopping for a balance transfer card, these six factors will help you zero in on the offers that deliver real savings:

Factor | Why It Matters |

|---|---|

Intro APR length | Longer 0% period gives you more time to pay down the balance. |

Balance transfer fee | A lower fee preserves more of your interest savings. |

Post-promo APR | Avoid cards that jump above 18% once the intro offer ends. |

Credit limit vs. balance | Make sure your new limit can cover the full amount you want to transfer. |

Eligibility requirements | Some cards require a 700+ FICO score to qualify. |

Rewards or perks | Nice to have—but never at the expense of a higher APR or fee. |

Before you dive in, decide if you need student balance transfer credit cards or are better off focusing on how to transfer credit card balance to 0 interest first.

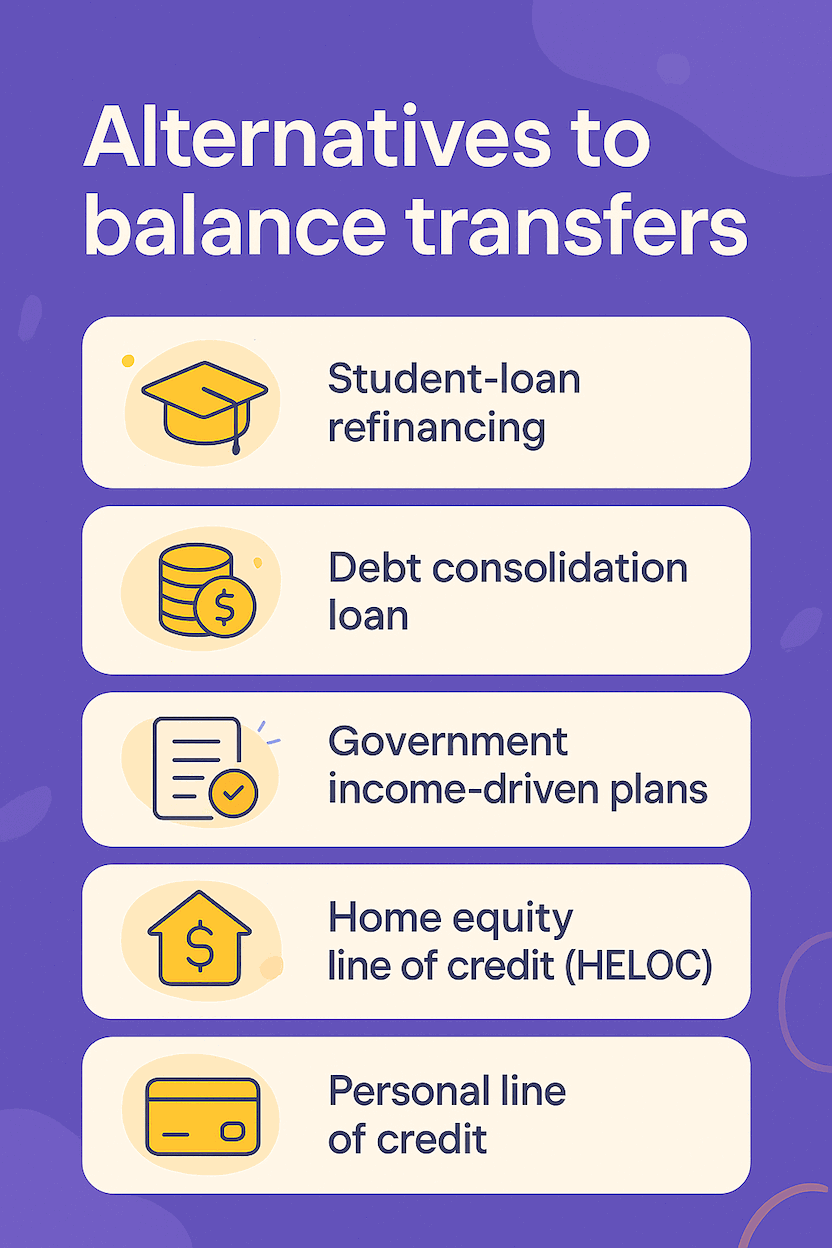

Alternatives to balance transfers

And if you’re exploring options that directly transfer student loan to credit card, understand that not all issuers permit this—so first verify if you can transfer student loans to a credit card with your provider.

If a balance transfer doesn’t quite fit your situation, consider these other strategies for lowering your overall cost of debt:

- Student-loan refinancing: Lock in a lower fixed rate on federal or private student loans—no transfer fees, no promotional cliff.

- Debt consolidation loan: Replace multiple debts with a single installment loan. You get predictable payments and avoid APR resets.

- Government income-driven plans: For federal student loans, these plans can lower your monthly payment without touching your credit cards—and may even offer forgiveness down the road.

- Home equity line of credit (HELOC): If you own a home, a HELOC can provide a lower rate than credit cards. But beware: your home serves as collateral.

- Personal line of credit: A flexible loan that you draw from as needed; often carries a lower rate than credit cards, though typically higher than secured loans.

Each option has its own requirements, fees, and risk profile—so weigh them against your credit health, budget, and long-term goals before deciding.

What is the downside of balance transfers?

The primary downsides include balance transfer fees, potential loss of promotional APR for late payments, and the temptation to rack up more debt on the cleared card. Plus, if you can't pay off the balance before the promotional period ends, you could end up paying higher interest rates.

The bottom line on balance transfer cards

Balance transfer credit cards can be a powerful tool for managing and reducing debt. They allow you to pause the accumulation of interest on your transferred balance for a set period, enabling you to pay down the principal more rapidly.

- Understand the terms: Before transferring a balance, make sure you understand the card's fees, the length of the promotional period, and the APR once the promotion ends.

- Consider the transfer fee: Typically between 3%–5% of the total balance transferred, this fee can affect the total savings.

- Be strategic: Only transfer balances that you are confident you can pay off during the promotional period to avoid higher interest rates down the line.

How to do a credit card balance transfer

- Apply for a card with an introductory 0% APR offer on balance transfers.

- Initiate the balance transfer by providing details of the existing debt you want to move.

- Pay down the balance responsibly to take full advantage of the interest-free period.

Requesting the transfer

You can request a balance transfer for a new card during the application process or after you've been approved. Some issuers allow online or over-the-phone transfers, while others may offer checks you can use to pay off other balances.

Beware of the grace period

Transfers can affect your card's grace period. Without careful management, new purchases could accrue interest immediately. Always read the fine print before accepting a credit card offer to avoid unpleasant surprises.

Potential pitfalls

Balance transfer cards aren’t a one-size-fits-all solution.

- Remember, introductory rates are temporary. Plan to pay off your balance before the standard APR kicks in.

- Avoid more debt. It's tempting to use the newly freed-up credit for more purchases, but this can lead to a deeper debt cycle.

Compare private student loans now

TuitionHero simplifies your student loan decision, with multiple top loans side-by-side.

Compare Rates

Where do you look for the right card?

Comparing offers from several issuers can help you find the best balance transfer card for your needs. Online financial marketplaces, credit card issuer sites, and personal finance blogs are great starting points.

Balance transfer cards, when used wisely, can greatly ease the financial burden of high-interest debt. For people struggling with large balances or looking to streamline their debts, they offer a breather—a chance to catch up without the progress being affected by high interest.

Properly executed, a balance transfer could save hundreds, if not thousands, of dollars in interest payments, making it a strategic move in the quest for financial freedom.

Dos and don'ts of using balance transfer credit cards

Navigating the world of balance transfer credit cards can be a game-changer for reducing high-interest debt. However, it's crucial to approach this strategy wisely to maximize benefits and avoid potential pitfalls. Here's a quick guide to help you make informed decisions when using balance transfer credit cards.

Do

Research and understand all fees associated with balance transfers.

Pay off the transferred balance within the promotional APR period.

Use the balance transfer as an opportunity to manage and reduce debt.

Compare multiple offers to find the best balance transfer card for your needs.

Don't

Don't ignore the potential impact of balance transfers on your credit score.

Avoid making new purchases on the balance transfer card unless necessary.

Don't miss payments, as this can result in losing the promotional APR.

Avoid transferring balances if you're not confident in paying them off within the promotional period.

Advantages and disadvantages of using balance transfer credit cards

Balance transfer credit cards offer a strategic way to reduce high-interest debt. By moving your existing balances to a new card with a lower or 0% introductory APR, you can save on interest and streamline your debt payments. However, these cards come with both advantages and disadvantages, which you should carefully consider to maximize their benefits.

- Lower interest rates: Balance transfer cards often offer low or 0% introductory APRs, significantly reducing interest payments.

- Debt consolidation: Allows consolidation of multiple debts into a single payment, simplifying management.

- Potential credit score improvement: Can improve credit score by lowering the credit utilization ratio if managed properly.

- Interest-free period: Provides a period to pay down debt without accruing additional interest.

- Financial breathing room: Offers a temporary break from high-interest charges, easing the financial burden.

- Balance transfer fees: Typically charge a fee (3%-5%) on the amount transferred, which can add up.

- Limited to good credit: Usually requires a good to excellent credit score to qualify for the best offers.

- Temporary benefit: The 0% APR period is temporary, and failure to pay off the balance can lead to high interest rates.

- Potential for more debt: The freed-up credit on old cards can tempt additional spending, leading to more debt.

- Risk of lost promotional rate: Missing a payment can result in losing the promotional APR and facing higher rates.

Legislative developments affecting credit card rates

In February 2025, Congress considered a bipartisan bill to cap credit card interest rates at roughly 28% for five years, aiming to shield consumers from post-promo APR shocks when introductory periods end.

If enacted, this cap would directly influence the “post-promo APR” factor in your comparison table, making longer 0% offers even more valuable if the permanent rate is limited.

Experts caution that while this relief could last only half a decade, it still represents a major shift in the cost structure of revolving credit.

Why trust TuitionHero

At TuitionHero, we understand the financial challenges of education. We provide resources like private student loans, scholarships, and refinancing options. We also guide you on using credit cards strategically to save on interest and navigate financial aid processes. Let us help you manage your finances effectively.

Frequently asked questions (FAQ)

While most balance transfer cards are designed for consolidating credit card debt, some issuers may allow the transfer of student loan balances. However, this feature isn't universally available and usually depends on the specific terms and conditions of the credit card and the issuer's policies.

Before pursuing this path, consider the implications, like the loss of potential student loan forgiveness and deferment options, which don’t apply to credit card debt. For more information on managing student debt, visit our section on private student loans.

To benefit from a 0% or low introductory APR offer, balance transfers usually need to be completed within a specified timeframe after account opening, usually within the first 60 to 120 days. Failing to transfer balances within this window could mean forfeiting the promotional rate, resulting in the application of the card's standard APR to your transferred balance.

While the primary benefit of balance transfer cards is the low or 0% introductory APR, a few select products may also offer rewards on new purchases. However, it's crucial to focus on the primary goal of reducing debt rather than accruing more through new purchases to earn rewards.

Prioritize cards with the best interest savings and terms over cards with rewards. Always read the fine print to understand exactly what you're signing up for.

New purchases on a balance transfer credit card typically incur interest at the card's standard rate unless there's also a 0% introductory offer on purchases. To maximize the benefit of a balance transfer card, it's generally recommended to avoid making new purchases and focus on paying down the transferred balance. Mixing transfers and purchases can complicate your debt reduction strategy and possibly lead to increased interest charges.

If you don't pay off the entire transferred balance before the end of the introductory period, any remaining balance will start accruing interest at the card's standard APR. This rate is usually higher than the promotional rate and can greatly increase the cost of your debt.

To avoid this, plan your payments to ensure you can clear the balance within the promotional period or consider another balance transfer to a new card with a 0% offer, bearing in mind that this may affect your credit score.

It depends on the issuer and the specific balance transfer offer. Some balance transfer credit cards allow you to transfer store cards (retail‐branded card) balances, but many restrict transfers to only other major credit cards.

Always check the fine print under “eligible accounts for balance transfers” before applying—your store card debt may or may not qualify.

You cannot pay federal student loans directly with a credit card, due to Treasury regulations.

However, some credit cards allow you to transfer private student loan balances as a “balance transfer,” subject to issuer approval and limits.

If you qualify for a 0% introductory APR offer and can pay off the transferred balance before the promo period ends, it could make sense—but check with your servicer and card issuer first.

The 2/3/4 rule is a Bank of America application restriction:

- 2 new cards approved in any 30-day period

- 3 new cards approved in any 12-month period

- 4 new cards approved in any 24-month period

Apply outside these limits and you’ll likely be denied.

Final thoughts

The journey through understanding and using balance transfer credit cards to save on interest is much like navigating any financial strategy – it requires diligence, understanding, and timely action. By leveraging the right balance transfer offers, people can reduce the interest paid on existing debts, accelerating their path to financial freedom.

Remember, the goal isn’t just to move debt around but to strategically pay it down while avoiding accruing more charges. Take advantage of the resources available from sources like TuitionHero to make informed decisions that boost your financial health. For more insights and help, explore our comprehensive guide on evaluating credit card offers.

Source

Author

Derick Rodriguez

Derick Rodriguez is a seasoned editor and digital marketing strategist specializing in demystifying college finance. With over half a decade of experience in the digital realm, Derick has honed a unique skill set that bridges the gap between complex financial concepts and accessible, user-friendly communication. His approach is deeply rooted in leveraging personal experiences and insights to illuminate the nuances of college finance, making it more approachable for students and families.

Editor

Brian Flaherty

Brian is a graduate of the University of Virginia where he earned a B.A. in Economics. After graduation, Brian spent four years working at a wealth management firm advising high-net-worth investors and institutions. During his time there, he passed the rigorous Series 65 exam and rose to a high-level strategy position.

At TuitionHero, we're not just passionate about our work - we take immense pride in it. Our dedicated team of writers diligently follows strict editorial standards, ensuring that every piece of content we publish is accurate, current, and highly valuable. We don't just strive for quality; we aim for excellence.

Related posts

While you're at it, here are some other college finance-related blog posts you might be interested in.

Shop and compare student financing options - 100% free!

Always free, always fast

TuitionHero is 100% free to use. Here, you can instantly view and compare multiple top lenders side-by-side.

Won’t affect credit score

Don’t worry – checking your rates with TuitionHero never impacts your credit score!

Safe and secure

We take your information's security seriously. We apply industry best practices to ensure your data is safe.

Finished scrolling? Start saving & find your private student loan rate today

Compare Personalized Rates